Tables are turning – used-car markets down in 2022, recovery in 2023?

12 September 2022

The pandemic saw European used-car markets deliver solid profits on prices that went through the roof. But the situation has changed this year and the used-car market is under pressure. Dr Christof Engelskirchen, chief economist at Autovista Group, provides an outlook for 2023.

Used-car markets boomed during the pandemic. Demand outstripped supply, as people looked for safe alternatives to public transportation and replaced older used cars with younger ones. Prices just kept rising.

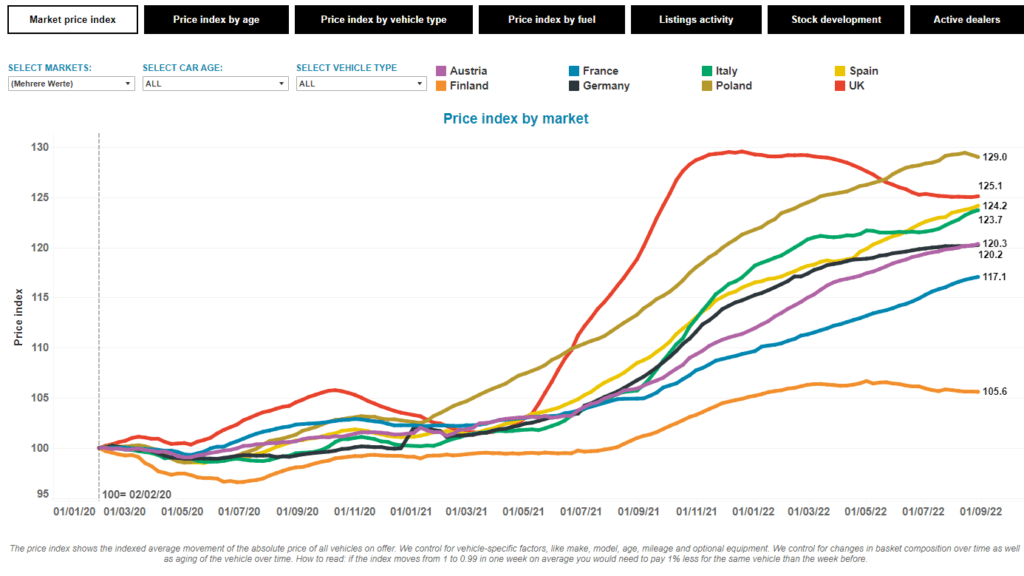

The reduction in new-car supplies also helped used-car markets to prosper. This delivered solid profits to stakeholders, who complained about a lack of supply. The rise in prices may have slowed lately, but the market has not yet reached its turning point – with the exception of some milder downward corrections, e.g. in Finland, Poland and the UK.

Used-car price index by country

Used-car transactions down in 2022

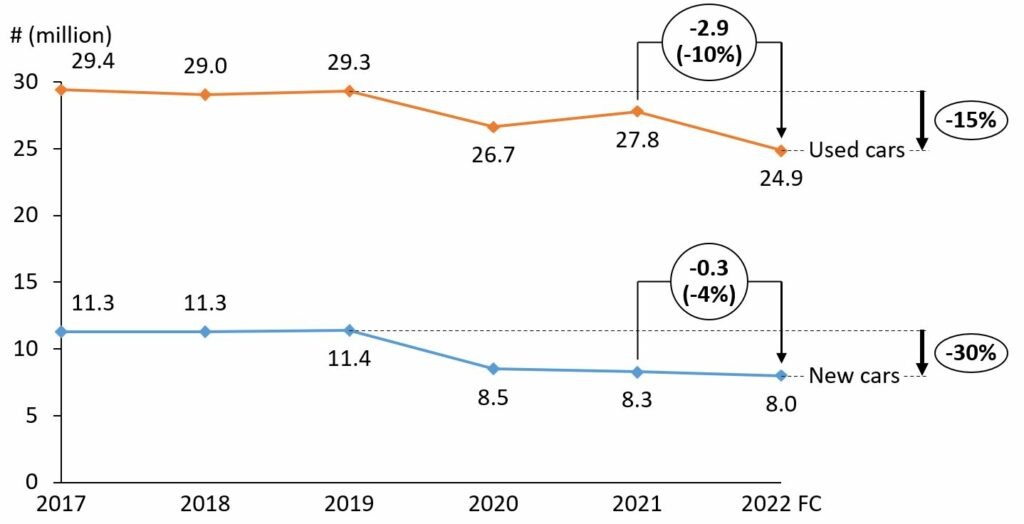

Used-car sales initially held up well compared to new-car registrations. Between 2019 and 2020, used transactions in the big five European markets (Germany, France, Italy, Spain, and the UK) dropped by 2.6 million units (from 29.3 million to 26.7 million), partly due to lockdowns. Used-car markets recovered swiftly to 27.8 million transactions, down merely 5% compared to pre-C0VID-19 year, 2019.

In contrast, new-car transactions fell by roughly 25% in 2020 compared to 2019 and ended slightly lower than in 2021. Based on the latest outlooks for 2022, new-car sales may contract further, but not on the same magnitude as used-car markets, which will lose roughly 3 million transactions in 2022 compared to 2021.

‘In the third year of broken supply chains for the automotive industry, tables are turning for used-car markets,’ comments Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group). ‘Used-car transactions are coming under pressure. Our most recent outlook indicates that for Germany alone, there will be one million fewer used-car transactions in 2022. There will only be roughly 5.7 million transactions compared to 6.7 million in 2021 – a contraction of 15%.’

New- and used-car transaction big five markets 2017-2022*

Consumer confidence at all-time low

This contraction is more substantial than many players had anticipated at the beginning of the year. There are several reasons why used-car markets tightened like this:

- With surging inflation, used-car prices have risen so much that elasticity of demand is kicking in. People are thinking hard about whether they can afford to buy a used vehicle at this price point. The alternative is to hold on to an existing used car for longer.

- Changing monetary policy from central banks aimed at combating inflation, bears a tangible risk of negative consequences on economies and job markets. This is another crucial factor that delays purchase decisions.

- The Russian aggression in Ukraine adds another layer of uncertainty to the equation, not only linked to rising costs for energy. Consumer confidence is at an all-time low.

- The continued lack of new-car supply also reduces the number of available used cars. For example, models registered in 2018/ 2019 which are now up for leasing renewal are facing longer holding periods as replacements are not coming in – reducing the number of used cars created. Furthermore, three years of lower-than-normal short-cycle registrations lower the number of (young) used cars in the market.

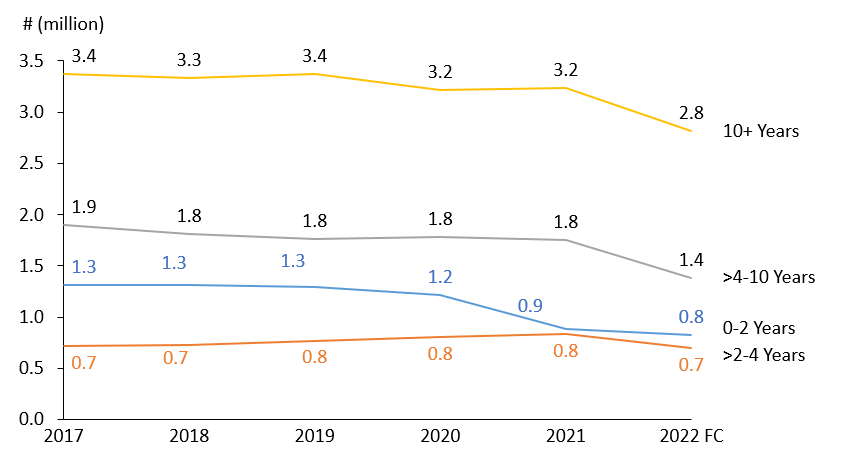

Fewer used-car transactions

The contraction of used-car markets is largely associated with older used-cars, i.e. those older than four, or even 10 years. ‘The transactions of younger used cars, especially those coming off leases, have held up remarkably well. They are largely on pre-crisis level’, said Marc Odinius, managing director at Dataforce. ‘We also see the anticipated dip in short-cycle registrations washing through to used-car markets now, as OEMs seek higher-value channels. That is why used-car transactions in the zero to two-year age cluster are down. But clearly, the most impactful contraction happens in the older-vehicle segments.’

Used-car transaction by age (example: Germany) Jan 2017-2022*

Source: National registration offices, Dataforce, Autovista24 analysis

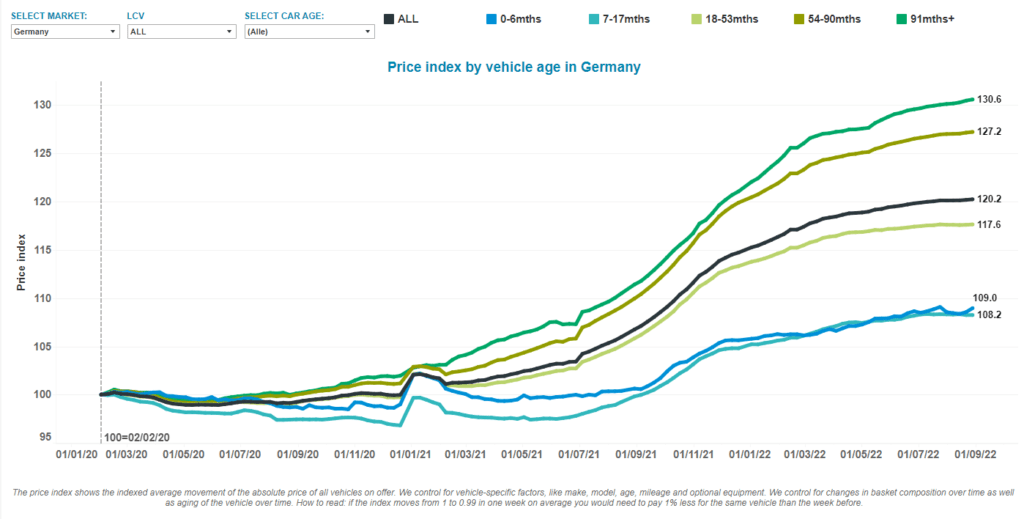

High prices reduce willingness to compromise

Used-car transactions are coming under pressure in the older than four-year segment. Prices were rising in this category more than in any other age group, which explains why this segment is now slowing down. According to Geilenbruegge, ‘the lack of abundant supply of cars combined with very high prices make it more challenging to find the right buyer for a specific car. At those prices, people are not willing to compromise and some walk away from the market.’

Used-car price index by age cluster (example: Germany)

Uncertain outlook for 2023

The origin of the current crisis lies in cracked supply chains, strong demand, as well as solid private and public spending power. Following the economic contraction in 2020, there was a quick rebound in 2021, which drove energy prices and inflation up already towards the end of 2021.

The Russian invasion of the Ukraine in early 2022 has driven energy prices up further. They account for roughly 50% of the inflation we are witnessing in Europe. Central banks are now biting down late, but harder, creating another element of economic stress. Furthermore, there are continued semiconductor shortages and lockdowns in China, which keep on disrupting supply chains. Autumn and winter waves of COVID-19 infections may also have a negative impact.

Autovista Group’s base case for 2023 anticipates continued supply chain issues, very low economic growth paired with high uncertainty, and inflation above target zones. This will keep new- and used-car markets under pressure. The current level of contraction on new-car markets is largely caused by supply chain issues – most cars due to be registered were ordered many months ago. Some of the automotive supply-chain issues should ease come 2023, which is the fourth year of the crisis.

New-car registrations should rise versus 2022. Used markets are expected to be stimulated accordingly, as more cars will be supplied. A recovery is expected in 2023 versus 2022 on both, new- and used-car markets, but this does not mean 2023 will be a rebound year for the automotive industry.

Of course, projections into 2023 are sensitive to assumptions on how quickly the abundance of negative factors will ease. There may be more positive scenarios evolving in 2023, for example if a stable ceasefire can be achieved in the Ukraine or if energy prices fall. However, it seems wise to caveat any outlook towards a more negative turn of events. For example, in its economic outlook in July, the IMF stated: ‘the risks to the outlook are overwhelmingly tilted to the downside’.